Should You Refinance Your Mortgage?

Anyone else have long lost high school friends who have all become experts in economics and finance on Facebook lately? I trust a YouTube video just as much as the next guy, but sometimes it’s nice to have some solid data from a trustworthy source.

Read on for some trustworthy info about refinancing from mortgage industry expert Myron Chamberlain.

Myron and I worked on our first deal around 9 years ago, when I was heavily into flipping my own homes. He was the lender representing the buyer of a home/flip I was selling. Immediately, I saw a difference in him. He gave me updates as a seller throughout the process, which is unusual in a real estate transaction. At the time, I had several lenders I was working with, so I didn’t give Myron a chance with my business. Over the years, things got choppy with those lenders: overpromising and underdelivering. He continued to check in and see how my business was going and we began to develop a friendship. This was so impactful for me.

At one point, I was on my 4th personal loan, and my lender at the time wasn’t helping me get it closed on time and I was close to losing my earnest money. I called several lenders, including Myron, and he came up with a simple solution to get it closed.

Over the years I closed numerous other personal and client loans through Myron. He won my business by being honest and reliable. In my opinion, those words are a rarity in the lending world.

Is now the time to look at refinancing your property?

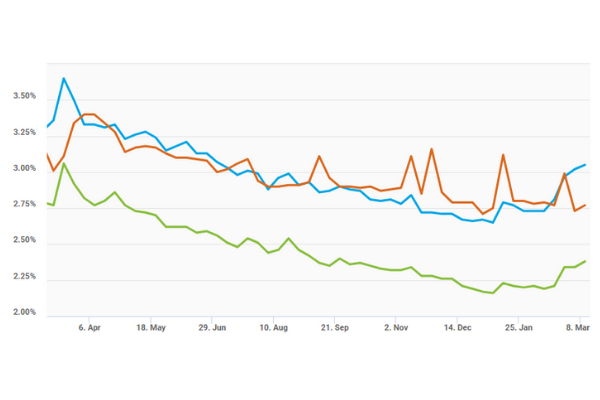

Now, with loan rates lower than where they were several years ago, I am again working with Myron to refinance some of my properties. One in particular, I bought around 2 years ago, and I can now save around $150 to $200 per month.

Here are a couple questions I asked Myron, along with his responses:

If you have a personal residence, at what rate would it be worth looking to refinance?

This answer will be unique to each client’s needs. As a rule of thumb, if your loan is $250,000 or below, the interest rate drop should be .75%. For loans between $250,000 and $500,000, many times a .5% drop in rate will create meaningful savings. And for loans above $600,000 a .375% drop can make a refinance worthwhile.

If you have an investment property, at what rate would it be worth looking to refinance?

Many of the same principles to question 1 will also apply to a rental property. In our market we are seeing a low yield curve which simply means “rate buydowns” on rental properties are more advantageous. Oftentimes a 1% “discount point” will lower the interest rate by .5%.

For example: if you owe $200,000, a 1% discount fee would be $1,000. A $1,000 buydown could lower your rate from 5.0% to 4.5% on your refinance. The savings this lower rate brings over 30 years well exceeds the upfront costs.

When should my savings be greater than my cost before it makes sense to refinance?

As a rule of thumb, most clients will want the savings to be more than their refinance costs within 2-3 years. If you believe you will be living in the home more than 2-3 years, refinancing at these currently low rates could be very worth your while. Call me for a no pressure loan review.

If you are looking at refinancing your loans, consider calling my friend Myron at 480-358-7801 or email him at mchamberlain@primelending.com. When you speak with him, let him know that his friend Carson said good things!

Stay updated with real estate tips and local events, restaurants, shops, and neighborhoods by filling out the form below:

Homes For Sale in 85250

Listing provided courtesy of ARMLS.

Listing provided courtesy of ARMLS. Listing provided courtesy of ARMLS.

Listing provided courtesy of ARMLS. Listing provided courtesy of ARMLS.

Listing provided courtesy of ARMLS. Listing provided courtesy of ARMLS.

Listing provided courtesy of ARMLS. Listing provided courtesy of ARMLS.

Listing provided courtesy of ARMLS. Listing provided courtesy of ARMLS.

Listing provided courtesy of ARMLS. Listing provided courtesy of ARMLS.

Listing provided courtesy of ARMLS. Listing provided courtesy of ARMLS.

Listing provided courtesy of ARMLS.All information should be verified by the recipient and none is guaranteed as accurate by ARMLS

All information should be verified by the recipient and none is guaranteed as accurate by ARMLS